Personal Injury Cases: Opportunity for Appraisers?

Among the most interesting types of engagements for valuation experts are personal injury cases—but not because the math is all that challenging (it isn’t). Rather, these cases test your ability to gather the right data and tell an easily understood story in a written report and on the witness stand. Of course, as with any new area of practice, you need to educate yourself in that area and examine its nuances.

Overview

Personal injury cases typically involve three types of damages: lost earnings, medical expenses, and lost household services Lost earnings include past loss of earnings, that is, earnings lost from the date of the incident to the date of the trial or settlement, and future loss of earnings, or earnings lost from the date of trial or settlement to the end of the plaintiff’s pre-accident work life expectancy, discounted to the present value Mitigating earnings are past and future earnings that an individual can achieve based on the individual’s health, age, experience, and other factors.

In a case I worked on recently, the plaintiff was an injured police officer whose biggest loss wasn’t future wages but the loss of retirement benefits. These are extremely generous in Oregon and increase rapidly with years of service.

To estimate future loss of earnings, you need to estimate work life expectancy, which is the number of years the plaintiff could have expected to work but for the loss event. The U S Department of Labor, Bureau of Labor Statistics publishes a commonly cited work life table. The discount rate to bring future cash flows into the present is a risk-free rate, using U S government securities. The period of loss determines the maturity of the bond that you use as a guide.

Mitigating earnings are deducted from lost earnings calculations. A vocational expert report is strongly advised for subjects who are totally or partially disabled Once a base wage for mitigating earnings is established, wage growth, fringe benefits, and work life expectancy are determined and future mitigating earnings are discounted to present value.

Past medical expenses are fairly easy to collect The hard part is determining future medical expenses For this, you need a medical expert to estimate future medical needs and a medical cost consultant to estimate the current cost of such treatment You can estimate the growth of such costs by using the Medical Care Price Index found in the Economic Report of the President. Again, the discount rate should be a risk-free rate.

The plaintiff is also entitled to recover the cost of past and future household services that can no longer be performed due to the incident. Household services include such functions as cooking, cleaning, auto repair, and gardening.

An expert comments

At the annual NACVA conference this past June, James Koerber, CPA/ABV, CVA, CFE, CFF (The Koerber Co., P.A. ), gave an excellent presentation on the subject of personal injury and how valuation experts can get involved as consultants I had the chance to speak with him recently.

Stuart Weiss: What are the main differences between a business lost profits analysis and personal injury or wrongful death engagements?

James Koerber: A business lost profits analysis might be related to a breach of contract, and there are a lot of guides out there. With personal injury and wrongful death, a lot of it is driven by case law, which is very state-specific. What you do in Mississippi may not apply to Alabama or Georgia You’ve got to be very careful about that.

SW: Since you’re not an attorney, and I don’t mean that disrespectfully, every jurisdiction has different laws. Do you let the attorney guide you?

JK: I do talk to the attorneys and ask whether any cases might affect my opinion. But we also read publications. The Journal of Forensic Economics produces articles on just about every state on how to handle personal injury and wrongful death economic damage calculations.

SW: How is the market for this type of work?

JK: If you do good work, the attorneys will know about you. We work for both plaintiffs and defense lawyers.

SW: Economists versus CPAs. Does it matter what your background is?

JK: No. An attorney once told me that the reason he hired college professors is because they were good teachers. If you’re qualified to do the work, it doesn’t matter whether you’re a college economics professor or a CPA. As long as you can understand issues regarding discount rates and growth rates and comply with the facts and circumstances of the case as well as case law of the particular state, you can make those calculations.

SW: Do you consider income taxes in your analysis?

JK: I can’t tell you that the case law in Mississippi is the same as in Oregon. But, in Mississippi, you do deduct taxes when projecting income. You want to put the person in the same position as before the accident. If you don’t deduct taxes, then you’re overcompensating the person. However, if case law says you don’t deduct it at all, then you have to abide by that state’s case law. Per Internal Revenue Code Section 104, the awards related to a personal injury or wrongful death are always tax-free—unless it’s punitive damages, which we don’t calculate

SW: Many times, people have medical expenses, but they’re covered by insurance. How do you deal with that?

JK: In many states, under the Collateral Source rule, you can’t bring it up in court. If a person is hurt who has disability insurance, you can’t bring it up in court to the jury. If there’s an injury, and an insurance company has paid benefits, then it will want to be compensated for any expenses it had to pay that may have been awarded for personal injury or wrongful death. But you don’t include insurance coverage of any kind.

SW: For the discount rate, why do you use the risk-free rate?

JK: The argument is that, but for the accident, you would have earned this money You shouldn’t be put in a position where you have to have a risky investment. Most states allow you to use U S Treasury rates. However, some states, such as Georgia, have specific rates as determined by the legislature

SW: Do you work with a vocational expert to analyze future earnings and a life-care planner to estimate future medical costs?

JK: The vocational expert is helping you to determine whether the person can return to work and when and how much they can earn. The life-care planner will tell you about the future medical needs including medical services such as doctors, hospitals, and medical equipment such as wheel chairs or special vehicles.

SW: If you got a call from Joan Rivers’s attorney, what are some of the factors that you would look at?

JK: You’d still have to look at work life tables. And someone who is 81 has only a few years left. To project it any further would just be speculation.

Example

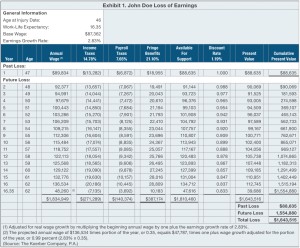

During his NACVA session, Koerber went through an example of a personal injury damages calculation. John Doe was 46 years old when he was injured in a car accident He had a high school diploma and some technical training as an electrician. He was employed by XYZ Corp for six years and had just been promoted to maintenance supervisor. The year before the accident, he earned $87,362 in total wages It was determined by examining his W-2s going back 10 years that his average wage growth was 2.83%. Fringe benefits of 21.1% were added, including Mr. Doe’s medical, dental, vision, long-term disability, and accidental death insurance plus the employer contribution to his retirement plan.

Work life expectancy was determined to be 16.35 years using the U.S. Department of Labor Bureau of Labor Statistics Work Life Estimates as well as other studies. The combined federal and state income tax rate (average, not marginal) was calculated at 14 78%, while the payroll tax rate was 7.65% for Social Security (6.2%) and Medicare(1.45%). A discount rate was determined to be 1.19%.

To calculate lost earnings, an Excel spreadsheet is set up to arrive at a loss of $1,643,515. (see Exhibit 1)

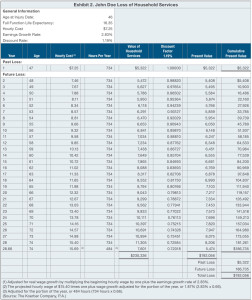

A similar calculation arrives at the value of lost household services as $192,056. (see Exhibit 2)

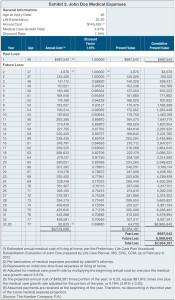

Past medical expenses totaled $987,542 (see Exhibit 3) Current medical expenses were estimated from a life- care planner Those expenses are projected forward by 32 2 years, using a life expectancy table for males aged 46. A growth rate of 3 91% was used for future medical costs and comes from the Bureau of Labor Statistics The present value of future medical expenses was $6,966,645 Total medical expenses were estimated to be $7,954,187.

Note that medical insurance benefits are not counted due to the Collateral Source Doctrine, which states that, in a personal injury action, evidence that the plaintiff’s medical bills were paid by insurance is not admissible. Some states have modified the rule on the grounds that it is unfair to allow an award of damages if the plaintiff has already been compensated.

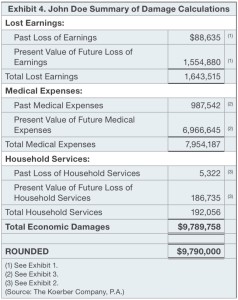

Adding lost earnings of $1,643,515 and lost household services of $192,056 arrives at total economic damages of $9,789,758 or $9,790,000 rounded (see Exhibit 4).

Your task will be to write a report in plain English and possibly explain on the witness stand why the plaintiff’s injury results in compensatory damages of nearly $10 million.

Final point

Although expanding your practice into personal injury cases is certainly feasible, you need to realize that you may come up against experts who do nothing but this type of work— and have been doing it for years. While the work may appear straightforward, there are always nuances in every area of practice. Therefore, make sure you are fully up to speed before you jump into this type of assignment Another good idea is to find a mentor who can help you in the beginning.